Reduce driver-related risk with continuous license monitoring, analytics, and training.

Drivers are the largest source of liability risk for fleets. On average, commercial fleets report a 20% crash rate per year. Accident and out-of-service costs continue to represent one of the largest fleet expenses, with motor vehicle accidents costing employers more than $56 billion and out-of-service costs for fleets going as high as $760 per vehicle per day.

It gets worse. The size of legal awards for on-the-job motor vehicle accidents is also soaring. In 2019, the average liability verdict award was $17.5 million, and the highest jury verdict for that year was a record-setting $280 million. And while some of these cases involved a wrongful death charge, more of them were due to negligence.

Negligence – or negligent entrustment liability – occurs when a dangerous article such as a vehicle is entrusted to somebody who is reckless, inexperienced, or incompetent. If the entrusted individual has an accident, the injured party has the right to bring a case against the individual’s employer. All the plaintiff needs to show to find fault with the employer is:

• The organization entrusted the vehicle to the driver

• The driver was reckless, incompetent, or unlicensed

• The organization knew – or should have known – that the driver was reckless, incompetent, or unlicensed

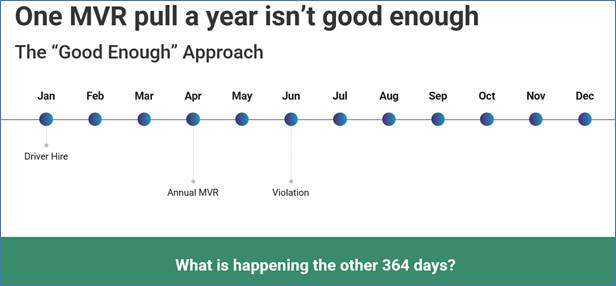

So how does this occur? According to Solera’s Adam Danielson and Josh Lax in our recent webinar, “The Risk of Overlooking Driver Safety,” most often it’s because the fleet only protects their own liability with the bare minimum, “good enough” approach mandated by our regulators: They pull motor vehicle reports (MVRs) once a year.

The problem with that approach is that it opens an extremely wide liability risk exposure gap of up to 364 days. If a driver receives a violation or suspension the day after the company pulls the MVR, they have a 364-day grace period before the infraction is discovered. That 364 days represents a lot of driving hours, and plenty of opportunities for that driver to have a traffic stop or be involved in an accident where the fleet could be liable.

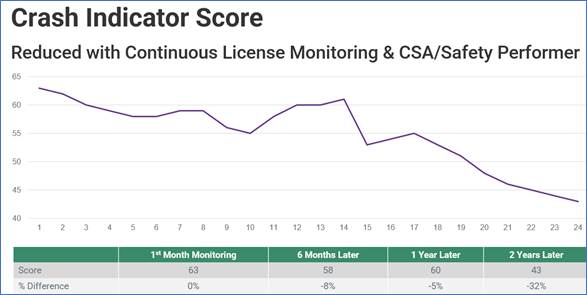

Thankfully how to close the gap on this particular issue is fairly simple: comprehensive continuous license monitoring. With the right continuous license monitoring solution, not only can a fleet manager understand the level of risk a particular driver poses to their organization at hiring, but throughout the driver’s employment.

When a new violation or license suspension occurs for a driver, a new MVR is automatically delivered to the manager. The manager can then take immediate corrective action with the driver, thereby closing this liability exposure gap.

However, a continuous license monitoring solution is not enough to fully remove all driver-related liability blind spots. A comprehensive safety culture is required for maximum risk reduction. It’s important that you create and solidify this safety culture around your drivers.

Today’s technology makes this relatively simple. The right solution offers features that make your life and your drivers’ lives easier. For example, features like digital recordkeeping and automated hazmat compliance streamline administrative tasks. A full-service safety suite can help you identify, train, and mitigate risky drivers. Add on a driver performance and retention module to identify, reward, and retain profitable drivers.

Don’t let 20% of your drivers cause 80% of your liability risk. Solera Fleet Solutions offers all these features and more with SuperVision, our comprehensive continuous license monitoring solution for fleets across the U.S. and Canada. If you want to hear more from Adam and Josh about how SuperVision can help your fleet mitigate risk and create a comprehensive safety culture, you can sign up to view their webinar on demand. For more information about SuperVision please contact us here or speak with your sales representative.